cryptocurrency tax calculator india

After the budget this calculator will tell you. As per current income tax laws an individual is required to report.

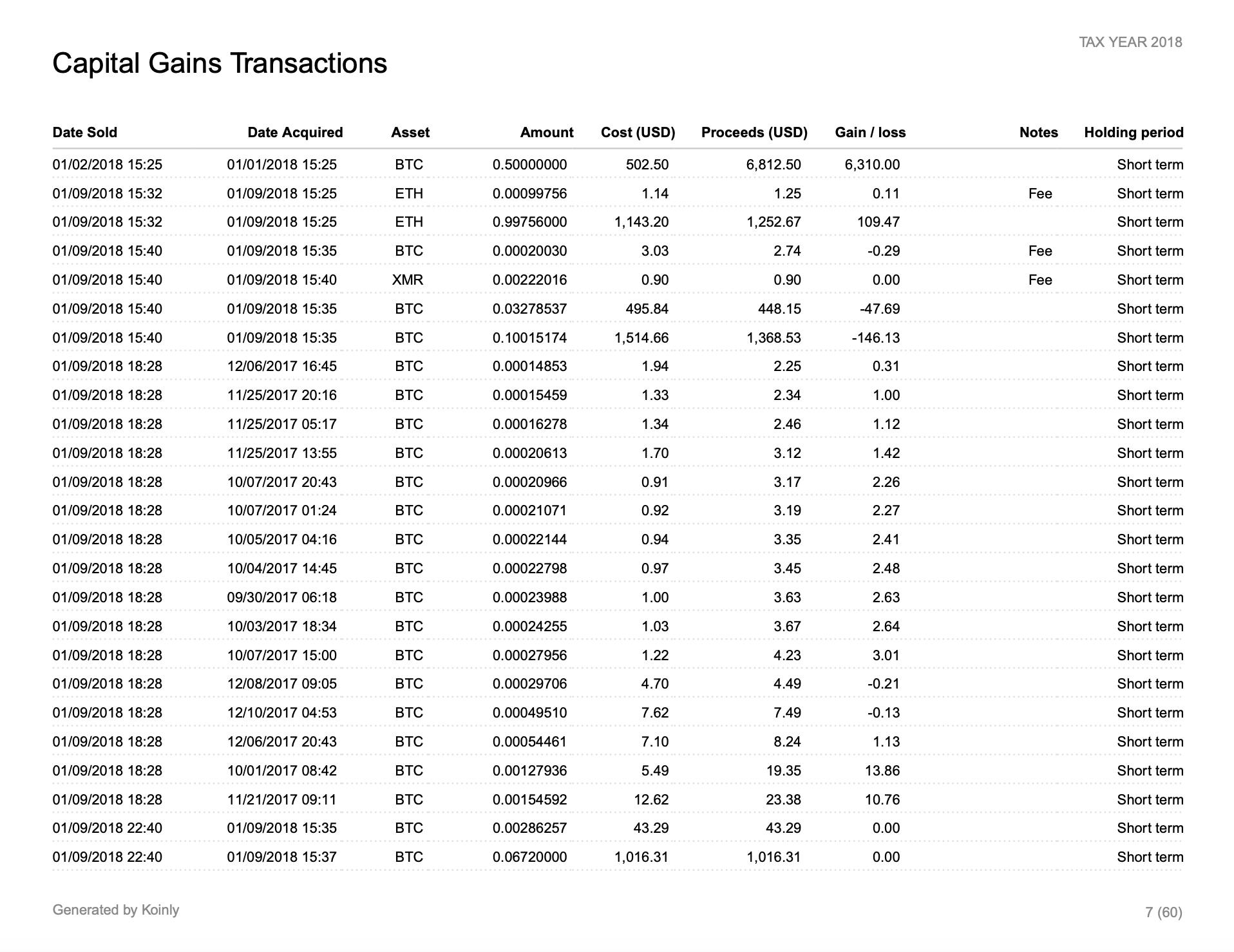

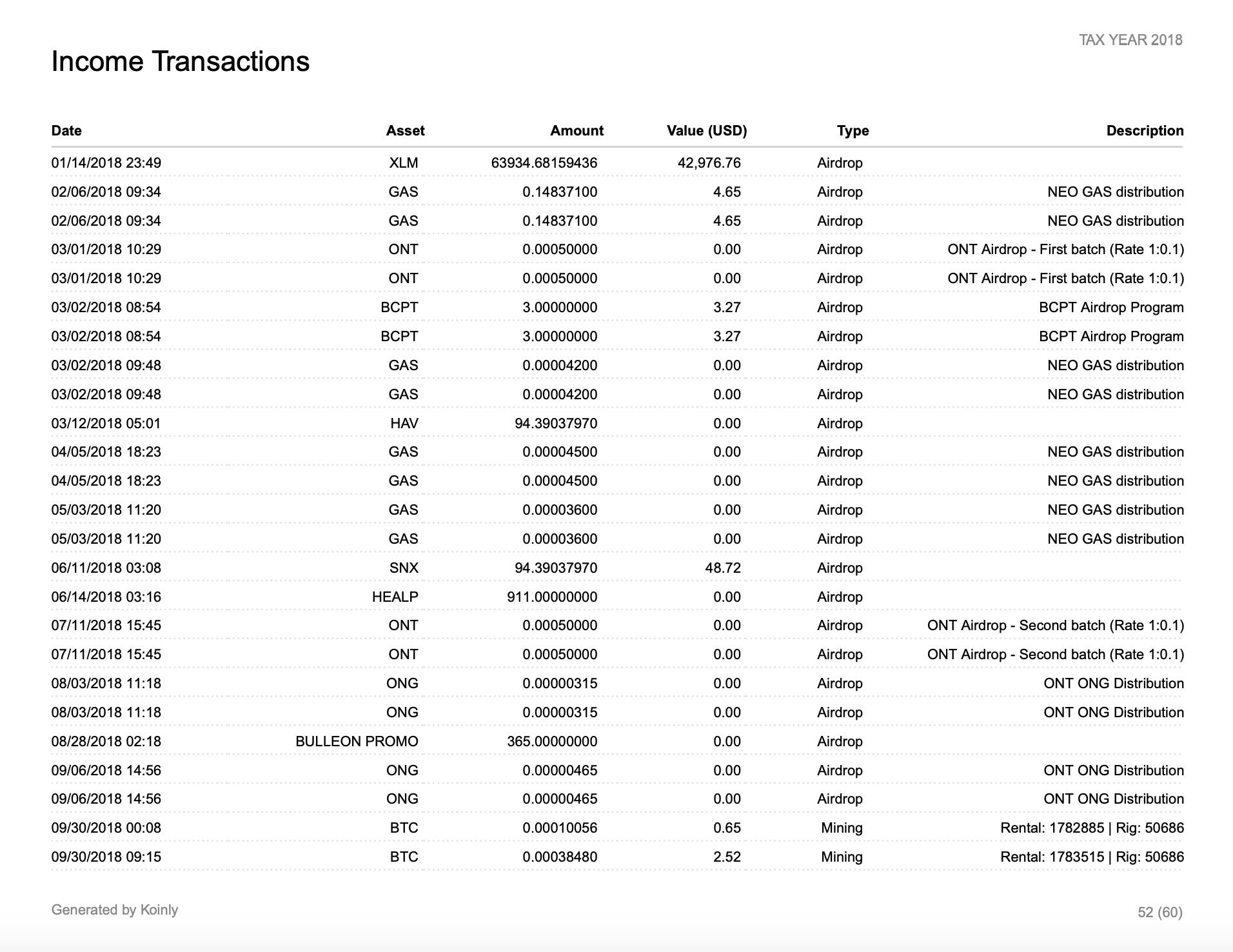

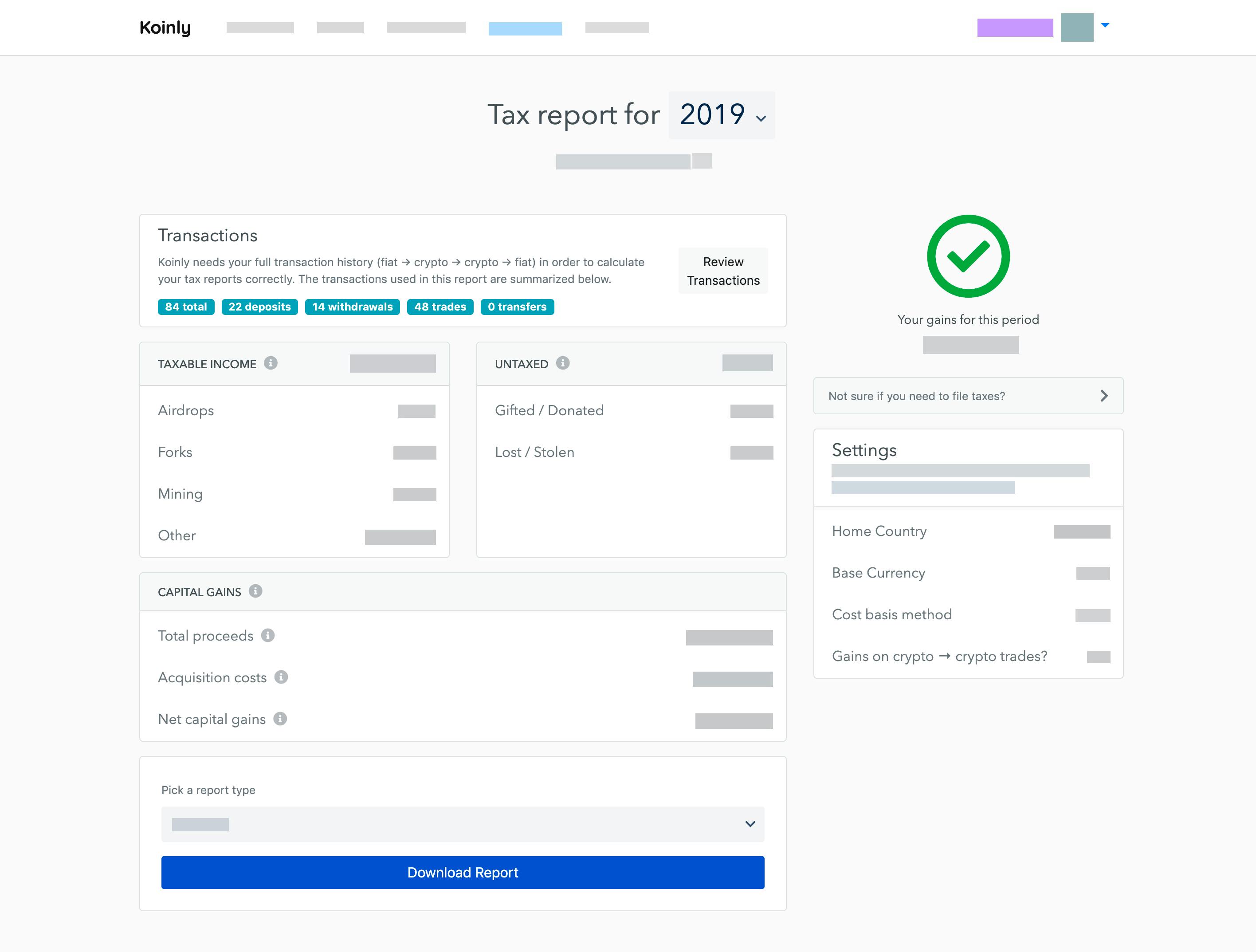

Cryptocurrency Tax Reports In Minutes Koinly

The government is looking into cases of alleged tax evasion by three mobile companies of China and notices have been given to them finance.

. Crypto Prices Today LIVE 29 August 2022. Read Crypto Market Today news Crypto coins price chart on The ET Markets. Tax calculator after budget 2011.

There will be no deduction allowed on any expenditure excluding the acquisition cost. Federal tax revenue comprises the total tax receipts received by the federal government each year. TAX DEDUCTED AT SOURCE CALCULATOR TDS2007-08.

A local body is not entitled to levy property tax from a company functioning in an industrial development area IDA notified by the state gove. But you would need to declare this in your US tax return and pay taxes thereon. In fiscal year FY 2021 income taxes will account for 50 payroll taxes make up 36 and corporate taxes supply 7.

Most of it is paid either through income taxes or payroll taxes. However there is no clarity on whether the cryptocurrency investments have to be reported in ITR even if there has been no trading and no gainslosses from the same. The tax-filing season in India begins in early January and our last minute investments continue to be made for as long as March.

At the third fortnightly review the government raised the windfall profit tax on the export of diesel to Rs 7 per litre from Rs 5 a litre and brought a Rs 2. In the case of dividends they are tax free in India. India Business News.

CT is one of the first cryptocurrency tax accounting firms in India having over five years of crypto. For interest earned in India you would first pay tax in India at the regular rates of tax. But do keep in mind that the HRA received from your employer is fully taxable if an employee is living in his own house or if he does not pay any rent.

Use this tool to calculate how much capital gain tax you will need to pay on gains from. Income Tax Calculator 2020-21. Calculate Taxes for FY 2020-21 based on new Income Tax Slabs for 2020-21.

Six new BAFs have come in the past one year alone. AIS is a comprehensive statement containing details of all the financial transactions undertaken by you in a financial year FY ie. Tax calculator financial year 10-11.

Tax deducted at source return etds. Your average tax rate is 1198 and your marginal tax rate is 22. This marginal tax rate means that.

The amount of HRA exemption is deductible from the total income before arriving at a gross taxable income. Dynamic asset allocation funds or balanced advantage funds BAFs have achieved a haloed status among investors and advisers alike. Then you would declare this income in the US return and claim a credit thereof.

With no change in the income tax rates and slabs an individual taxpayer will continue to pay the same rate of tax depending on the tax regime chosen for FY 2022-23. If you make 70000 a year living in the region of New York USA you will be taxed 12312. Wealth Edition 4 SEPTEMBER 2022 - The Economic Times.

Learn and stay informed about cryptocurrency in India. While the tax-paying population in India is on the lower side the income tax collection during 2018-19 amounted to 442170 crore. Most experts agree that gains or losses in cryptocurrency trading have to be reported in your income tax return ITR.

It contains the information that are specified under the Income-tax Act 1961 The AIS contains information related to. The Income-tax department has seized unaccounted deposits worth more than Rs 55 crore and unearthed evidences of large-scale hidden investments after it recently raided Viresh Josh a former. Bitcoin Ethereum Solana Dogecoin Tether latest price trends Crypto price changes updates Crypto market recent updates crypto coins announcements videos and more.

Further you can also file TDS returns generate Form-16 use our Tax Calculator software claim HRA check refund status and generate rent receipts for Income Tax Filing. Under both income tax regimes tax rebate of up to Rs 12500 is available to an individual taxpayer under section 87A of the Income-tax Act 1961. 30 tax on cryptocurrency in India is applicable on the income transfer from cryptocurrencies.

Your investments in stocks bonds mutual funds gold land property etc are subject to capital gain tax. Last fiscal 2020-21 about 589 crore ITRs. Crunch has teamed up with crypto tax calculator Koinly to offer fast and accurate bitcoin and cryptocurrency tax reporting.

India Business News. The Annual Information Statement AIS is a tool that tells taxpayers what the tax department knows about them. However agriculture income is included while computation for the limited purpose of determining the tax rate in computing the income tax liability if the net agricultural income exceeds Rs 5000 for say FY15 and total income excluding net agricultural income exceeds applicable basic income exemption of Rs 250000.

The crypto investments have grown despite any precise regulation from the Indian Government or Reserve Bank of India. The rules on applying a tax on cryptocurrency in India in the Finance Bill 2022 are as follows. Capital gains and losses are taxed differently from income like wages interest rents or royalties which are taxed at your federal income tax.

In the past 2-3 years mutual funds have seen enormous inflows but one category has emerged a favoured pick. Calculate Income Tax for the Men Salaried Women Senior CitizenTax calculator will let you know your pre-budget tax liability on your salary. Is a one-stop solution for cryptocurrency taxes and has a physical presence in the United States and India.

Over 23 crore Income Tax Returns ITRs were filed till July 20 for the financial year 2021-22. Rules for Tax on Cryptocurrency in India. Tax calculator income tax.

It went on to hold that input tax credit on purchase of demo cars cannot be denied merely because such vehicles are capitalised or because they may be later sold at a. This helps an employee to save tax. Tax calculator fy 11-12.

China Seeks A Role Global Crypto Framework In 2021 Global Role Framework

Mutual Funds Taxation Rules In India Capital Gains Period Of Holding Mutuals Funds Capital Gain Capital Gains Tax

Tds Due Date List May 2020 Accounting Software Solutions Date List

Crypto Tax India Ultimate Guide 2022 Koinly

Download Income Tax Calculator Fy 2018 19 Excel Template Exceldatapro Income Tax Interest Calculator Credit Card Interest

Income Tax Paying Taxes The Outsiders Income Tax

Cryptocurrency Tax Reports In Minutes Koinly

Tax Computation On Earnings From Crypto Assets In India Binance Blog

8 Financial Ratio Analysis That Every Stock Investor Should Know Financial Ratio Money Management Advice Finance Investing

Crypto Tax Calculator Bitcoin Ethereum Doge And Other Cryptocurrencies Coins Tax2win

Cryptocurrency Tax Calculator Forbes Advisor

Why You Have To Calculate Tax Return Income Tax Income Tax Return Tax Return

Hsn Chapter By Name Harmonized System Coding India

Cryptocurrency Tax Reports In Minutes Koinly

Pin On Robotina Ico Ama Live Event

How To File Form Itr 5 Income Tax Return Digital India Step Guide

Crypto Tax Calculator Bitcoin Ethereum Doge And Other Cryptocurrencies Coins Tax2win